Top 5 E-Wallet Apps Development Trends You Can’t Ignore in 2024

In today’s fast-paced digital world, e-wallet applications have emerged as essential tools for facilitating seamless financial transactions. With the increasing demand for cashless solutions, it has become crucial for businesses and developers to stay ahead of the curve. The e-wallet landscape is rapidly evolving, and 2024 promises to be an exciting year for this domain. In this article, we will explore the top five e-wallet apps development trends that you can’t afford to overlook.

1. Enhanced Security Features

With the rise in online financial transactions, security remains a paramount concern for users. The increasing incidence of cyber threats emphasizes the need for robust security measures in e-wallet applications. Developers are leveraging advanced technologies such as biometric authentication, AI-driven fraud detection, and end-to-end encryption to fortify security. Multi-factor authentication (MFA) is also gaining popularity, adding an additional layer of protection for user accounts and sensitive information.

2. Integration with Blockchain Technology

Blockchain technology stands out as a revolutionary force in the financial sector. Its decentralized nature provides numerous advantages, such as transparency, security, and reduced transaction costs. E-wallet apps are increasingly incorporating blockchain to enable faster and more secure transactions. Furthermore, blockchain can facilitate smart contracts, allowing users to engage in automated agreements without intermediaries. Developers who embrace this technology will gain a competitive edge in 2024.

3. Artificial Intelligence & Machine Learning

The use of Artificial Intelligence (AI) and Machine Learning (ML) has begun transforming the e-wallet ecosystem. AI can analyze users’ spending habits, enabling personalized recommendations and tailored financial insights. Moreover, ML algorithms can help in identifying potential fraudulent activity by detecting anomalies in transaction patterns. These advancements not only enhance user experience but also contribute to overall security, thus driving user engagement and retention.

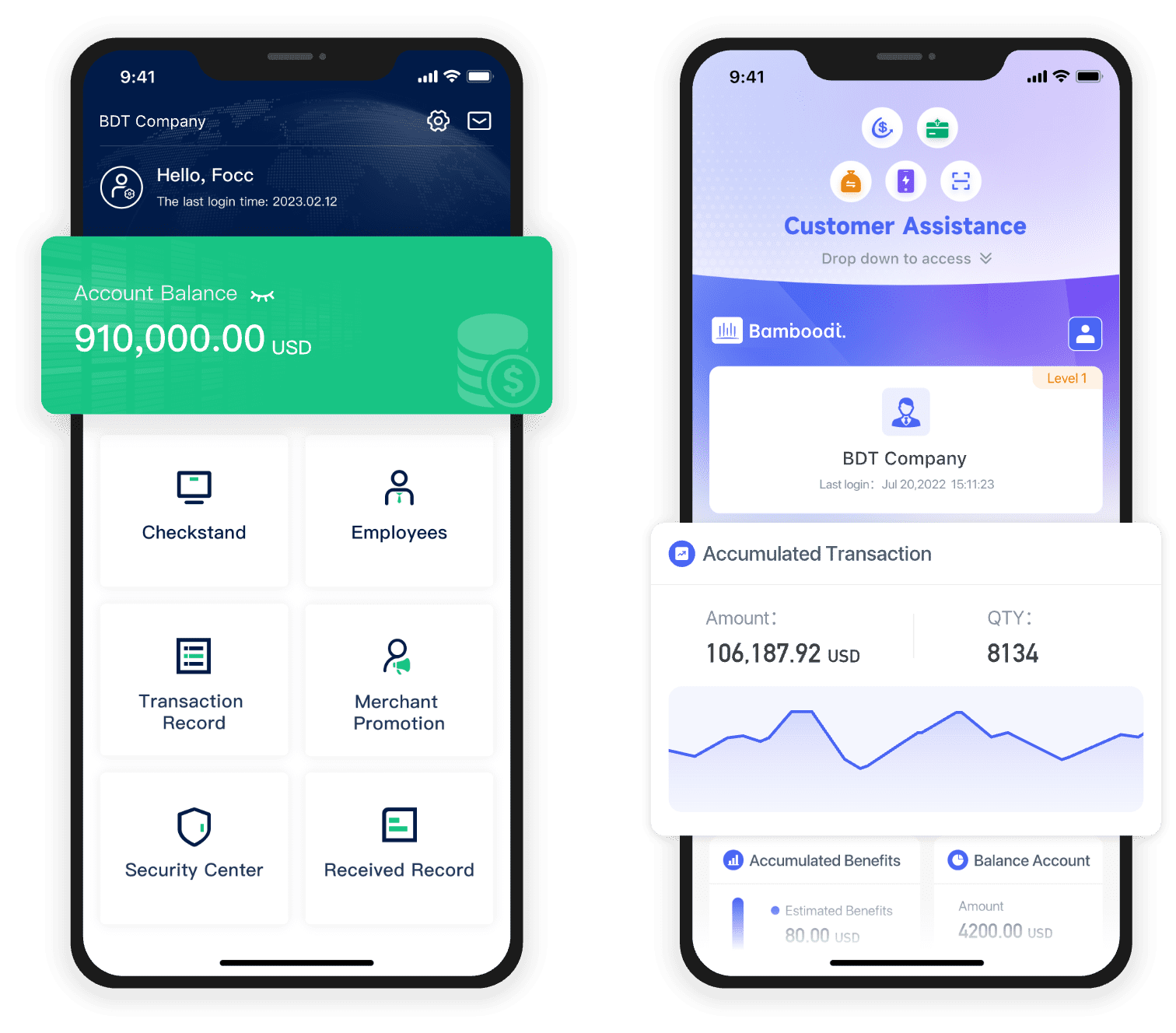

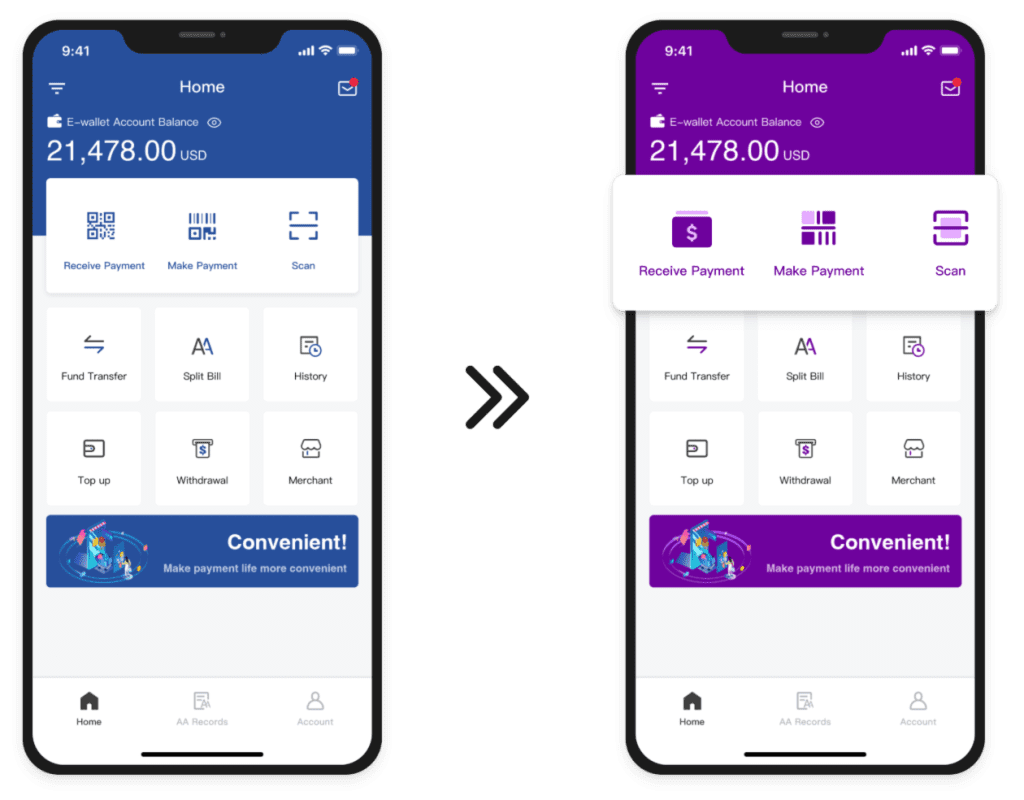

4. User-Centric Design

As competition intensifies in the e-wallet arena, user experience (UX) and interface design have taken center stage. A well-designed e-wallet app can significantly impact user adoption and satisfaction. In 2024, developers will need to prioritize a user-centric approach by incorporating intuitive navigation, responsive design, and visually appealing aesthetics. Conducting user research to understand target audience preferences will be essential. Moreover, accessibility features should be built into the design to cater to all users, including those with disabilities.

5. Expansion of Payment Methods

The diversity of payment methods is expanding as users look for flexibility and convenience. Traditional payment options such as credit and debit cards remain popular, but alternative methods like cryptocurrencies, digital checks, and buy now, pay later (BNPL) services are growing in demand. E-wallet apps that offer multiple payment options will likely attract a broader user base. Developers should consider integrating these varied methods to highly enhance customer satisfaction and increase transaction volume.

Future Prospects in E-Wallet Development

The future of e-wallet app development holds immense potential as technology continues to advance. As we move through 2024, it’s vital for developers to remain adaptable, continually exploring new technologies and trends. A keen understanding of market demands will be instrumental in the success of e-wallet solutions. Continuous market research, user feedback, and an agile development approach will empower teams to innovate effectively and stay aligned with evolving user needs.

Regulatory Considerations

As e-wallets grow in popularity, regulatory frameworks surrounding digital transactions are also evolving. Developers must stay informed about regulations that govern financial transactions in various regions. Compliance with laws such as the General Data Protection Regulation (GDPR) in Europe or the Payment Card Industry Data Security Standard (PCI DSS) is crucial. Non-compliance can lead to severe financial penalties and reputational damage, emphasizing the importance of regulatory knowledge in e-wallet development.

Collaboration with FinTech Companies

Collaboration between e-wallet developers and established FinTech companies is another trend set to rise in 2024. Such partnerships can lead to the incorporation of innovative solutions and features that would otherwise be challenging to develop independently. By leveraging the expertise, resources, and networks of FinTech organizations, e-wallet developers can accelerate growth and enhance their service offerings.

Focus on Sustainability

The growing awareness of environmental issues is influencing various industries, including financial technology. E-wallet developers are expected to incorporate green practices in their operations and promote eco-friendly payment options. Additionally, educating users about sustainable practices in their financial activities can foster loyalty and enhance a brand’s reputation among conscientious consumers.

Conclusion

The e-wallet app development landscape is in the midst of transformational changes. By staying attuned to emerging trends and consumer demands, developers can create innovative solutions that not only meet user needs but also thrive in a competitive market. The trends outlined in this article present opportunities for both entrepreneurs and established businesses to capitalize on the growing shift toward digital financial transactions in 2024.