Essential Guidelines for Developing a Successful E-Wallet App

The rise of digital wallets has revolutionized the way we conduct transactions. With the advancement of technology, traditional banking methods are increasingly being replaced by mobile e-wallet applications. As the world continues to embrace cashless transactions, businesses looking to thrive in this environment need to invest in e-wallet app development. This article will provide in-depth insights into the essential guidelines for developing a successful e-wallet app.

Understanding the Market Trends

Before embarking on the development of an e-wallet app, it’s crucial to understand the current market trends. The e-wallet industry has witnessed exponential growth, fueled by the increasing smartphone penetration and the growing acceptance of digital payments. According to a report by Statista, the digital payments segment is projected to see an annual growth rate of 11.64% from 2021 to 2025, leading to a market volume of approximately $13,883 billion by 2025.

With such promising statistics, entrepreneurs and developers must analyze the competition, including existing players like PayPal, Venmo, and Cash App. Understanding their features, user interface, and customer feedback can provide invaluable insights into what works and what doesn’t.

Defining Key Features for Your E-Wallet App

Once you have a grasp of market demands, the next step involves outlining the core features your e-wallet app must possess:

- User Registration and Verification: Users should easily create accounts through email or social media, followed by a robust KYC (Know Your Customer) process for identity verification.

- Multiple Payment Options: Your app should support various payment methods, including credit/debit cards, net banking, and even cryptocurrencies.

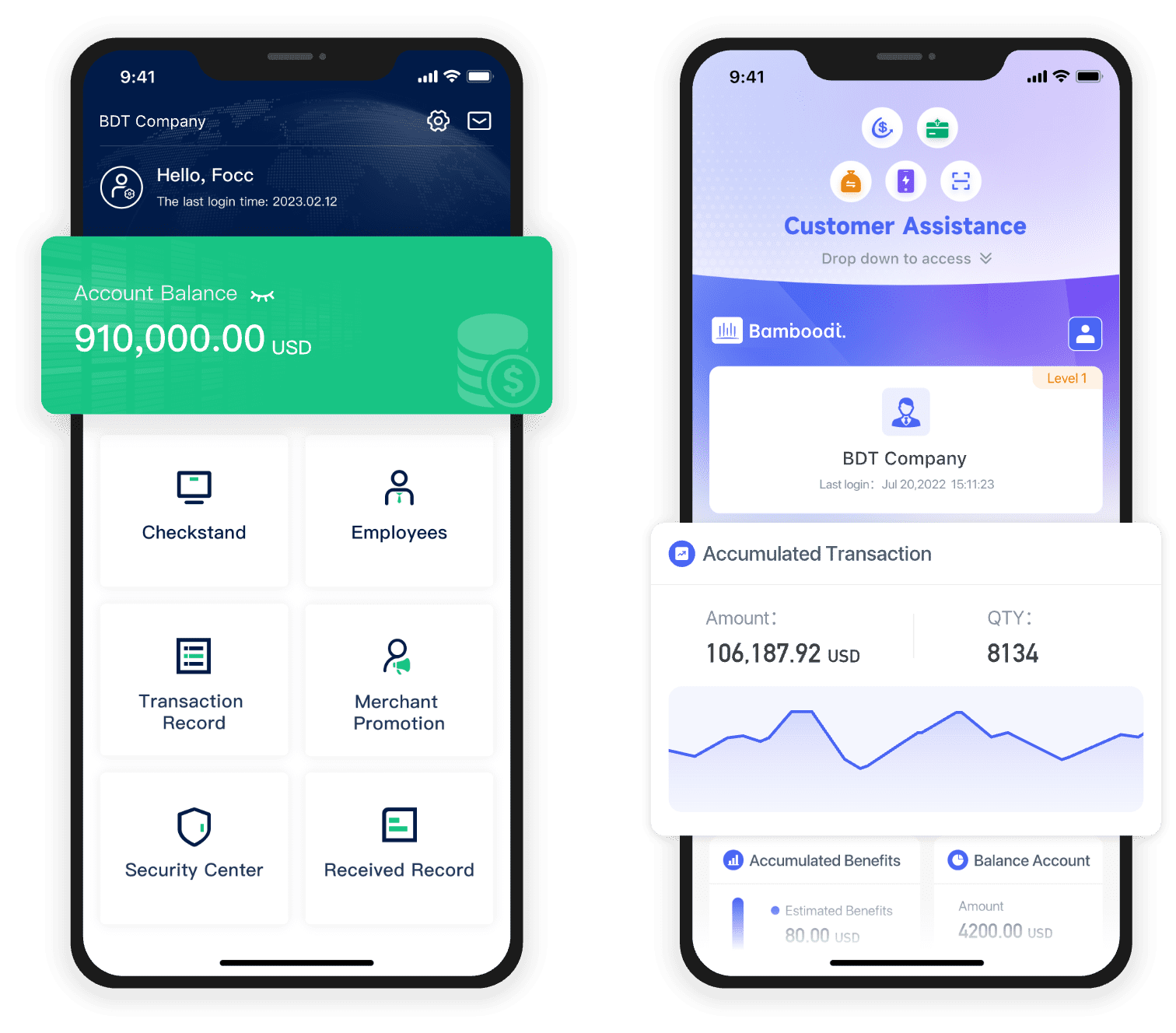

- Transaction History: Users must be able to track their transactions, including incoming payments, outgoing payments, and refunds.

- QR Code Scanner: Incorporating a QR code scanner can enhance the payment experience for users, enabling quick transactions.

- Security Features: Prioritize security by implementing features like two-factor authentication, encryption, and biometric verification.

- In-App Customer Support: Providing customer support within the app can enhance user experience, allowing users to resolve issues promptly.

Choosing the Right Technology Stack

The choice of technology stack plays a crucial role in the development of an e-wallet application. The right stack should not only support your app’s functionality but should also be scalable and secure. Here are some popular technologies:

- Frontend Development: Consider using React Native or Flutter for a seamless cross-platform experience.

- Backend Development: Node.js or Ruby on Rails can be great options due to their performance, scalability, and community support.

- Database: Use secure databases like MongoDB or PostgreSQL to store user data and transaction records.

- Payment Gateways: Integrate reliable payment gateways such as Stripe, Braintree, or PayPal to facilitate transactions.

Designing a User-Friendly Interface

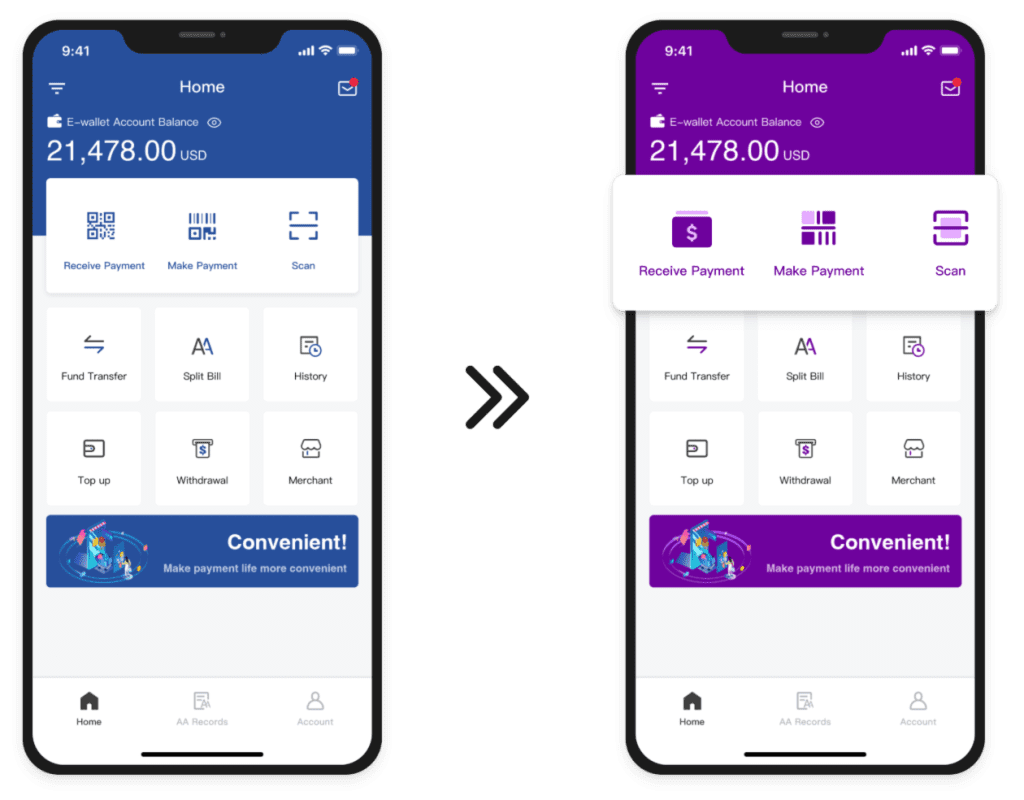

An attractive and intuitive user interface is a fundamental aspect of any successful e-wallet application. The user experience should be seamless, making it easy for users to navigate through various features. Here are some design principles to guide you:

- Simplicity: Remove unnecessary elements and focus on essential features. A clean design can enhance usability.

- Consistency: Ensure that your design elements are consistent across the entire app, including fonts, colors, and button styles.

- Accessibility: Make sure your app is accessible to users with disabilities by following accessibility guidelines and best practices.

- Responsive Design: Design your app to work on various screen sizes and orientations, ensuring a positive experience on both smartphones and tablets.

Implementing Security Measures

Security is paramount when developing an e-wallet app. Users expect their financial information to be protected at all costs. To mitigate risks, implement the following security measures:

- Data Encryption: Encrypt sensitive data both in transit and at rest to minimize the risk of data breaches.

- Regular Security Audits: Schedule regular security assessments and penetration testing to identify and fix potential vulnerabilities.

- Compliance: Adhere to regulatory standards such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation).

- User Education: Provide users with information on safe practices when using your app, such as recognizing phishing attempts and securing their accounts.

Marketing Your E-Wallet App

After developing your e-wallet app, a comprehensive marketing strategy is essential to ensure its success. Here are some effective marketing tactics:

- Search Engine Optimization: Optimize your app’s listing in app stores with relevant keywords and attractive visuals to enhance visibility.

- Social Media Promotion: Leverage social media platforms to engage with potential users and promote your app’s features.

- Referral Programs: Create referral incentives to encourage current users to invite friends and family to use your app.

- Content Marketing: Produce valuable content around fintech, digital transactions, and personal finance to establish authority and attract users.

Analyzing User Feedback and Continuous Improvement

Post-launch, it is imperative to gather user feedback and analyze app performance metrics. User reviews provide insights into what features resonate with your audience and which areas require improvement. Tools such as Google Analytics and in-app user surveys can help you gather valuable data.

Continual iteration based on user feedback not only enhances user satisfaction but also fosters loyalty, encouraging users to choose your app over competitors.

In summary, developing a successful e-wallet app requires a thorough understanding of market dynamics, a solid feature set, the right technology stack, a focus on user experience, stringent security measures, and effective marketing strategies. By following these guidelines, developers can create an e-wallet app that stands out in a competitive landscape and meets the needs of today’s consumers.