8 Key Steps to Develop a Secure and User-Friendly E-Wallet App in 2025

By John Fintech | Posted on August 15, 2025 | Mobile Development

The Evolution of Digital Payments

Global mobile payment transactions are projected to reach $12 trillion by 2025, with e-wallet apps leading this financial revolution. As cashless payments become the norm, businesses face both tremendous opportunities and technical challenges in creating competitive digital wallet solutions.

1. Market Research: Finding Your Niche

Analyzing Current Statistics

- 73% of consumers prefer mobile wallets over physical cards

- Contactless payments increased by 149% post-pandemic

- Asia-Pacific leads in mobile payment adoption (58% penetration)

Competitive Feature Analysis

| Feature | Basic Wallet | Advanced Solution |

|---|---|---|

| Biometric Auth | ❌ | ✅ |

| Cross-border Transfers | ❌ | ✅ |

2. Tech Stack Selection: Building for Scale

// Sample API integration code

const processPayment = async (amount, receiver) => {

try {

const response = await PaymentGateway.process({

amount: amount,

currency: 'USD',

receiverId: receiver

});

return response.transactionId;

} catch (error) {

handlePaymentError(error);

}

}

Essential components for modern e-wallet architecture:

- Node.js or Python for backend development

- React Native/Flutter for cross-platform apps

- PCI-DSS compliant payment gateways

3. Security Measures: Protecting Digital Assets

Multi-Layer Authentication

Implement 2FA+ solutions combining:

- Fingerprint/Facial recognition

- One-time passwords (OTP)

- Behavioral biometrics

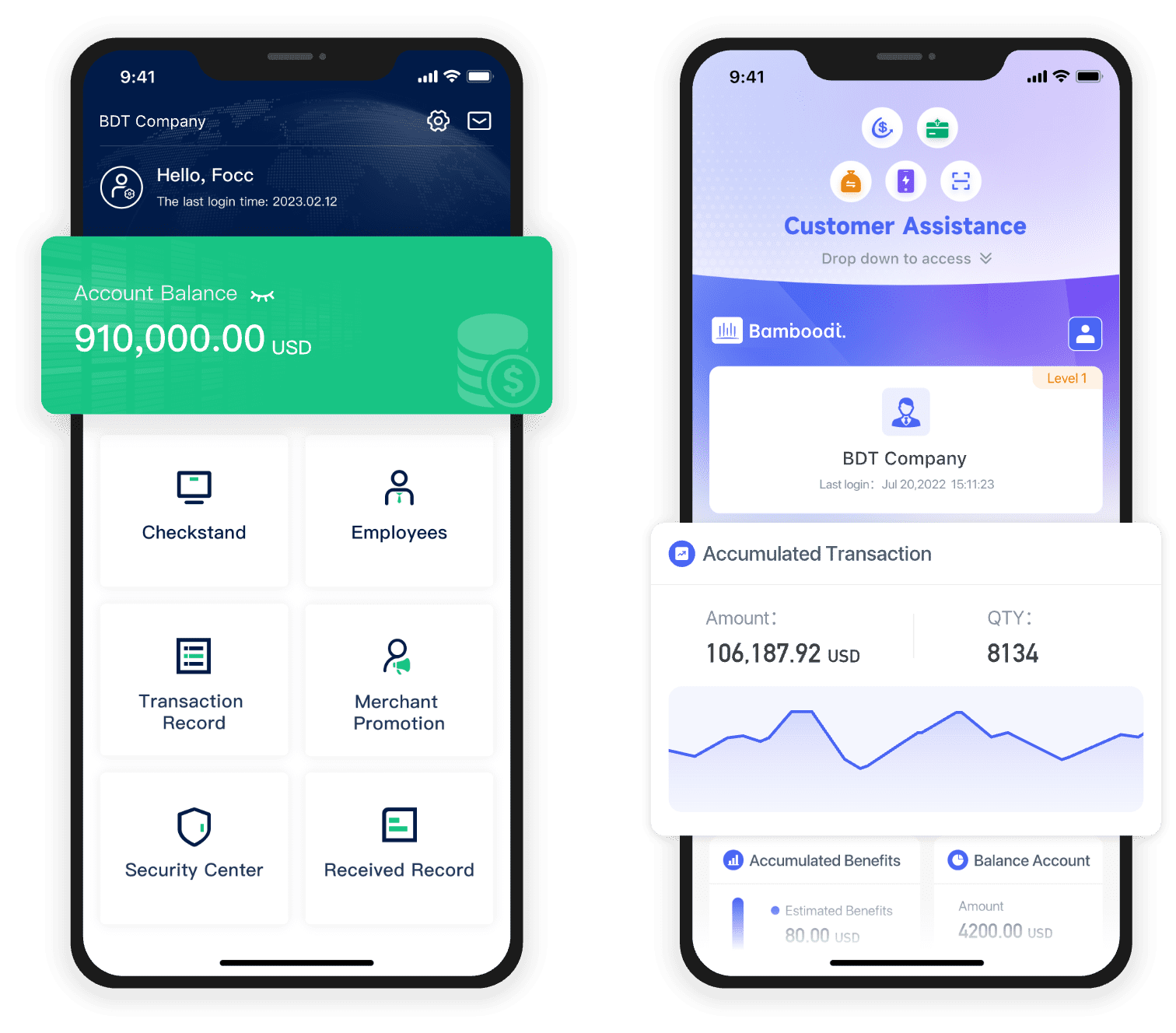

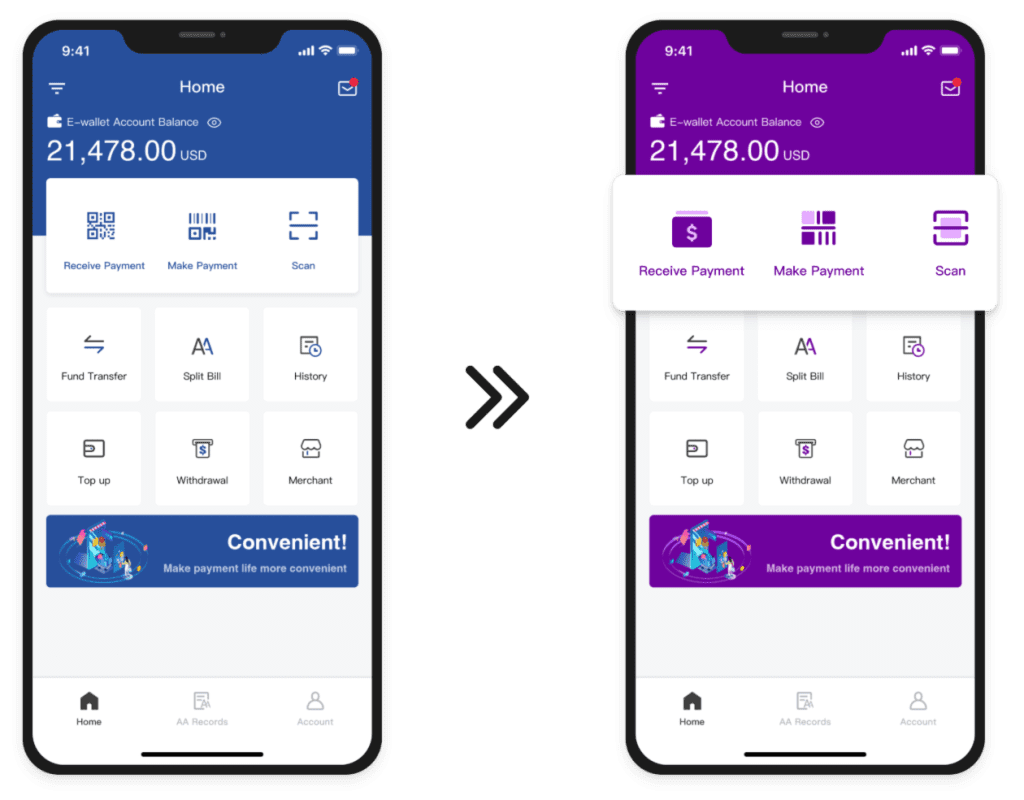

4. UI/UX Design Principles

Common user pain points in payment apps:

“73% of users abandon apps with complicated payment processes”

– 2025 Mobile Payment UX Report

Essential UI Elements:

- Instant balance visibility

- Spending analytics dashboard

- Real-time transaction alerts

5. Payment Gateway Integration

Comparative analysis of popular gateways:

- Stripe ⭐⭐⭐⭐ (9.1/10)

- Braintree ⭐⭐⭐⭐ (8.7/10)

- Adyen ⭐⭐⭐⭐½ (9.3/10)

6. Regulatory Compliance Challenges

Global Requirements:

- GDPR (EU data protection)

- PSD2 (European payments)

- PCI SS v4.0 (Security standards)

7. Testing Protocols

Essential test cases for fintech apps:

- Load testing (10,000+ concurrent users)

- Security penetration testing

- Currency conversion accuracy

8. Deployment & Marketing Strategy

Pre-Launch (Weeks 1-4)

Beta testing with 500+ users

Launch Phase (Week 5)

App Store Optimization strategy implementation

Post-Launch Maintenance

User Retention Tips:

- Monthly feature updates (86% retention boost)

- 24/7 customer support channels

- Personalized financial insights